-

KRUK GROUP

- KRUK S.A.

- Shareholding

- Mission, vision and values

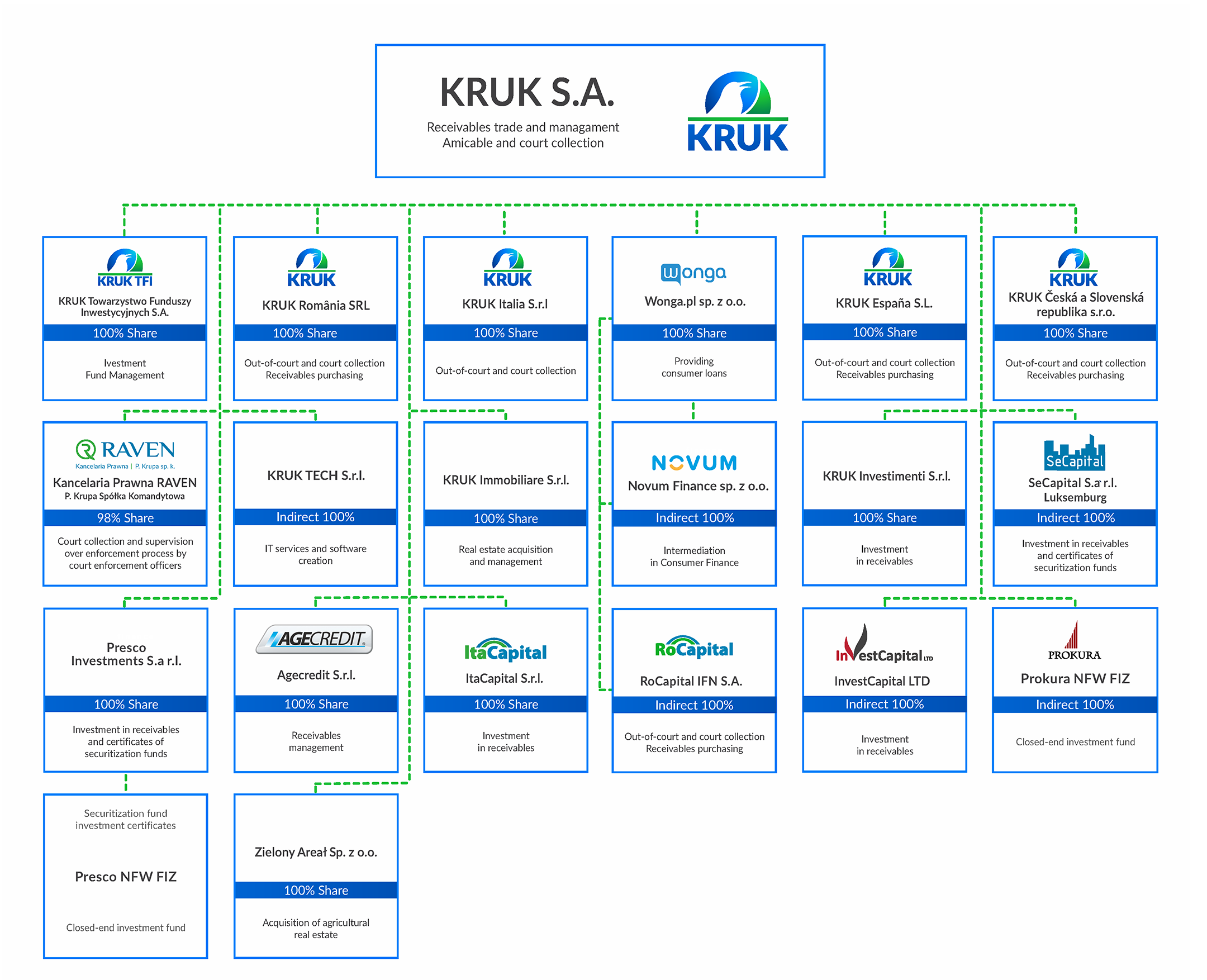

- KRUK Group structure

- Board, Supervisory Board and GM

- Milestones

- Associations

- Corporate documents

- Code of Best Practices of Companies Listed

- Remuneration Policy

- Gender diversity in KRUK S.A.

- ESG

Learn more about KRUK Group core business and strategic objectives

Shareholding structure of the KRUK S.A.

Become familiar with the mission and vision of KRUK Group, as well as with the values the Group embraces in its contacts with the customers, business partners, co-workers, and shareholders.

See the KRUK Group structure

Learn more about authorities of the KRUK Group

Learn more about milestones in the history of the KRUK Group

Learn more about the associations the joint-stock companies of KRUK Group belong to in Europe ans the U.S.

See the corporate documents of KRUK S.A.

Learn more about Code of Best Practices of Companies Listed on the Warsaw Stock Exchange

Learn more about the Remuneration Policy for Members of the Management Board and Supervisory Board of KRUK S.A.

- NEWS

-

REPORTS

See annual and quarterly reports of the KRUK Group

See selected current reports of the KRUK Group

List of recommendations and external reports about KRUK group

See financial data by year and generate an interactive chart

-

KRUK SHARES

Current stock price and historical data on charts

Take a look at translation of our IPO prospectus available

Dividend and historical data on dividend payments

- BONDS

- CONTACT